Sap Business One Vs Microsoft Dynamics 365

The SAP vs. Oracle debate is common among large, complex companies. Clients often ask us, “which is the better ERP software system?” Of course, as an independent ERP consultant, we determine the best fit for our clients based on their unique business requirements. However, we’d still like to provide a comparison of SAP and Oracle based on industry benchmarks and client experience.

Conclusion of the Comparison between SAP Business One and Microsoft Dynamics 365. In summary, it is tough to say with certainty which of the two software packages comes out ahead in the comparison between SAP Business One vs. Microsoft Dynamics 365. While the above overview may seem to suggest that Dynamics 365 has a noticeable advantage over. Dynamics 365, on the other hand, allows you to select individual modules to create a customized solution that aligns perfectly with the way your business operates. Conclusion Microsoft Dynamics 365 surpasses SAP Business One. It can extend its advantages to both start- ups and the largest of enterprises by providing scalability, flexibility. Compare Microsoft Dynamics 365 vs SAP Business One. 585 verified user reviews and ratings of features, pros, cons, pricing, support and more.

SAP primarily builds its products from the ground up rather than through acquisition. The vendor targets companies with at least $1 billion in annual revenue. SAP ERP software has deep functionality, so it requires a very technical, time-consuming implementation.

S/4HANA Cash Application enables real time, intelligent invoice-matching powered by machine learning.

Oracle’s primary strength is acquiring product lines that can provide flexible functionality to a variety of industry niches. However, niche functionality is still transitioning from EBS and JD Edwards into Oracle’s newer products. Oracle targets companies with at least $750 million in annual revenue.

Oracle Business Intelligence 12c provides seamless analytics across cloud and on-premise solutions.

Both SAP and Oracle provide a full business suite of solutions, including HCM software, CRM software, SCM software, etc. Both vendors were featured in our manufacturing ERP report and distribution ERP report on the top ERP systems for those industries. The vendors in these reports have robust supply chain management and inventory management capabilities. They also offer strong production management software.

SAP vs. Oracle Case Study

SAP and Oracle both invest heavily in cloud technology. However, our client was skeptical about cloud scalability and unsure if the products were mature and proven.

Based on our experience evaluating and implementing these ERP solutions for clients, we’ve gleaned some interesting insights:

We help clients create requests for information (RFIs) to send to ERP vendors. These RFIs list the client’s business requirements in detail. Vendors must indicate if (and how) their solution can fulfill each requirement. Below are examples of some of the requirements fulfilled (or not fulfilled) by various SAP and Oracle products. It is broken down by functional area:

Business Requirement: The ability to support manufacturing production management.

Business Requirement: The ability to auto-recommend warehouse staging location for products based on delivery (ship-via) type.

Business Requirement: The ability to support user-configurable invoice structure.

Business Requirement: The ability to track historical product pricing at the customer level by sales rep (user).

Business Requirement: The ability to create and display user defined hierarchies for dashboards and reporting purposes.

Business Requirement: The ability to support integration with external benefits platforms.

As you can see, SAP and Oracle can both support a variety of business requirements with minimal software configuration. These are the kind of answers companies want to see in a RFI response. Even if some configuration is required, it is greatly preferred to software customization, which SAP and Oracle both strongly recommend against.

Check battery status laptop. The products mentioned above are not the only products these vendors offer. You can find a complete list in our vendor database.

We regularly coordinate ERP vendor demonstrations for clients. After each demo, clients score functionality on a scale from 1 to 5. The highest score a vendor can receive is a 5. The following metrics are based on clients’ ratings of SAP and Oracle across a variety of products during the last two years:

SAP and Oracle Products Scored Closely in These Areas

Industry Intelligence – IBM partnered with SAP to create a Cognitive Demand Forecasting Solution for the retail industry. The solution can be integrated into SAP S/4HANA and the SAP Customer Activity Repository. Oracle Demand Management Cloud is a supply chain management solution that accurately predicts customer demand for a broad range of industries.

Material Requirements Planning – (SAP) 1.8 / (Oracle) 1.9

Industry Intelligence – SAP recently updated its material requirements planning (MRP) capabilities within SAP S/4HANA. Oracle NetSuite also has recent updates to its MRP.

Industry Intelligence – SAP Business One has a fixed asset management function that eliminates the need for repetitive manual data entry. Oracle NetSuite Fixed Asset Management automates asset acquisition, depreciation, revaluation and retirement.

Industry Intelligence – SAP Upscale Commerce allows manufacturers and merchants to quickly launch “pop-up” e-commerce stores. Oracle Commerce On-premise, has likely stopped releasing updates. However, Oracle Commerce Cloud is frequently updated, with its last update this month.

Industry Intelligence – SAP ECC has improved precision in currency conversion of foreign exchange rates.

Industry Intelligence – SAP Audit Management instantly captures audit documentation while providing drag-and-drop tools. You can access the application through mobile devices.

User-Defined Dashboards – (SAP) 3.9 / (Oracle) 1.4

Industry Intelligence – Not all BI vendors provide user-friendly dashboards. However, SAP BusinessObjects allows you to create interactive, role-based dashboards accessible from any device. An alternative is SAP Analytics Cloud, which allows you to easily create predictive models and integrate them into workflows.

Industry Intelligence – Oracle has a new set of artificial intelligence applications that automate processes within its cloud suite.

Customer Contract Management – (SAP) 3.0 / (Oracle) 3.7

Industry Intelligence – Oracle Project Contract Billing Cloud provides pre-built templates and automates project billing. The application ensures contracts are compliant with project billing requirements.

Industry Intelligence – Oracle Purchasing Cloud automates routine transactions, such as invoice validation. The application fully integrates with accounts payable modules.

Industry Intelligence – Oracle Product Lifecycle Management Cloud allows you to define inspection plans by connecting product design standards and quality specifications.

While these scores are just averages of more detailed metrics, they show the perceived strengths and weaknesses of each ERP system. Demo scores are one of several factors to consider during an evaluation of SAP and Oracle.

Sap Business One Vs Microsoft Dynamics 365 Office

SAP and Oracle both have products with multiple deployment options. They typically encourage our clients to consider cloud-based technology even if they’ve expressed interest in on-premise technology.

Focusing on cloud ERP is a smart move for SAP and Oracle as the market is increasingly demanding flexible deployment options. However, we’ve found that neither SAP nor Oracle have very many references for cloud implementations at large, complex companies.

While SAP and Oracle aren’t likely to go out of business any time soon, they occasionally discontinue certain products.

SAP S/4HANA is a fairly new platform for SAP. The product has strong R&D funding as does Oracle ERP Cloud. However, R&D spending on Oracle EBS on-premise, is waning as the product is moving exclusively to the cloud. It’s difficult to find technical resources to implement EBS on-premise as most Oracle system integrators are focused on the cloud.

Want to learn more? Our SAP vs. Oracle white paper features a case study on a client in the distribution industry.

When evaluating ERP vendors, it can be helpful to consider industry benchmarks and independent research. Our comparison report, 2019 Clash of the Titans, provides benchmarks on some of the challenges companies experience when implementing SAP or Oracle:

According to our report, SAP projects last around 14.7 months, while Oracle projects take about 12 months. One possible reason that SAP projects take longer is because its clients are typically global and complex companies. These companies choose SAP because of its scalability and robust functionality. Global ERP projects naturally require a longer time commitment due to the number of locations and decisions about standardization vs. localization.

ERP implementations can cause operational disruptions, such as the inability to manufacture or ship products.

Disruptions that occur during SAP projects last about 128.5 days, while disruptions that occur during Oracle projects last about 121.7 days. This might reflect the fact that SAP works with large companies with complex, global operations. An operational disruption at a large company can affect multiple locations, which can take more time and effort to resolve.

To reduce the risk of operational disruption, companies should take a phased implementation approach. It’s also wise to conduct multiple conference room pilots before go-live.

Resource allocation is one of the most common struggles for companies implementing enterprise software. While ERP vendors typically recommend at least eight to twelve full-time internal resources, this isn’t feasible for most companies. Many companies heavily rely on external resources from the vendor and systems integrator. Unfortunately, this increases implementation costs.

Companies implementing Oracle use slightly more internal resources than companies implementing SAP. In both cases, respondents reported that their team was almost an even split between internal and external resources.

Complex customization is a major reason why companies rely on external resources. Oracle is a flexible solution that typically requires simple customization and configuration that can be done in-house.

Role of ERP Software in Companies’ Digital Strategies

More than half of SAP customers reported that their ERP project played a significant role in their digital strategies. However, this was true for less than half of Oracle customers.

Oracle’s marketing strategy seems to focus on promoting specific modules, such as finance. This might attract more companies looking to automate particular processes and fewer companies looking to transform their entire operating model.

SAP and Oracle both provide robust ERP systems that can transform your company. These benchmarks don’t prove one vendor is better than the other, but highlight challenges companies may face.

Diving deeper into these challenges, it’s apparent that they’re not caused by technical shortcomings. Both of these vendors provide value to companies that understand how enterprise resource planning software aligns with their goals.

Comparing Oracle and SAP requires an in-depth understanding of software capabilities, deployment options and vendor and product viability. An informed decision also requires business process reengineering and requirements definition prior to selection. Armed with this insight, a company can decide whether SAP, Oracle or another system altogether best fits their business needs.

When you grow from a startup to a mid or large-size organization, operations become increasingly difficult to handle. A business needs a focused and systematic approach to manage planning, development, manufacturing, marketing, sales, finances, operations, customer service, human resources and other day-to-day activities to cope with rapid expansion. Most businesses turn to Enterprise Resources Planning (ERP) solutions such as Dynamics 365 and SAP to help. An ERP manages corporate processes through an integrated application

This can get complicated. Which ERP features do you need? What should your budget be and how do you calculate a return on investment? And most importantly: which vendor should you choose? These questions are all critical because choosing the right ERP for your enterprise can be a game-changing decision.

Click here to download our free ebook on Dynamics 365 and get answers to your questions!

This is the first part of a series of three articles that compares Dynamics 365 to the ERP market leaders. The selected ERPs for this comparison are SAP, Oracle, and Infor. Part one of this series will focus on SAP.

Dynamics 365 for Finance and Operations Overview

Microsoft Dynamics 365 is a flagship product for Microsoft. It launched in November 2016, was repackaged in July 2017, and is still evolving. In this comparison, we will not cover NAV, GP, AX, and SL. Instead, we will review Microsoft’s new offering: Dynamics 365 for Finance and Operations. This product is distinct since it is offered in the cloud opposed to other products which are bought and installed on premises

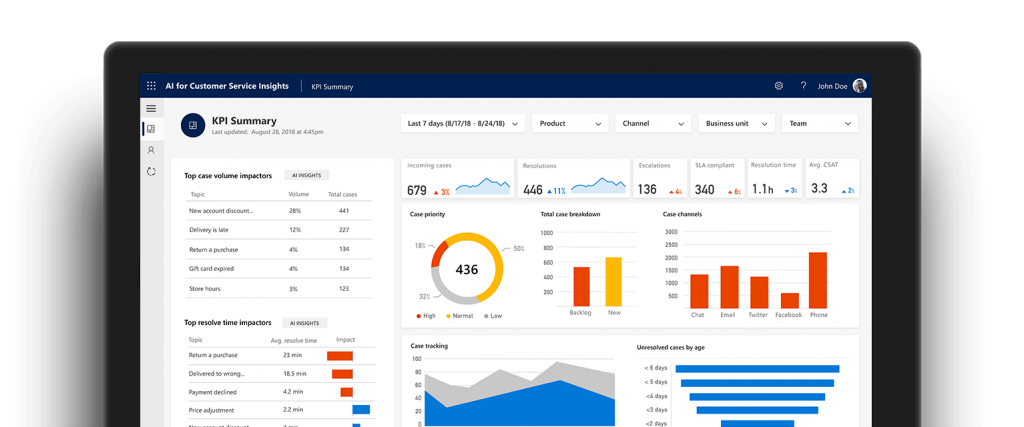

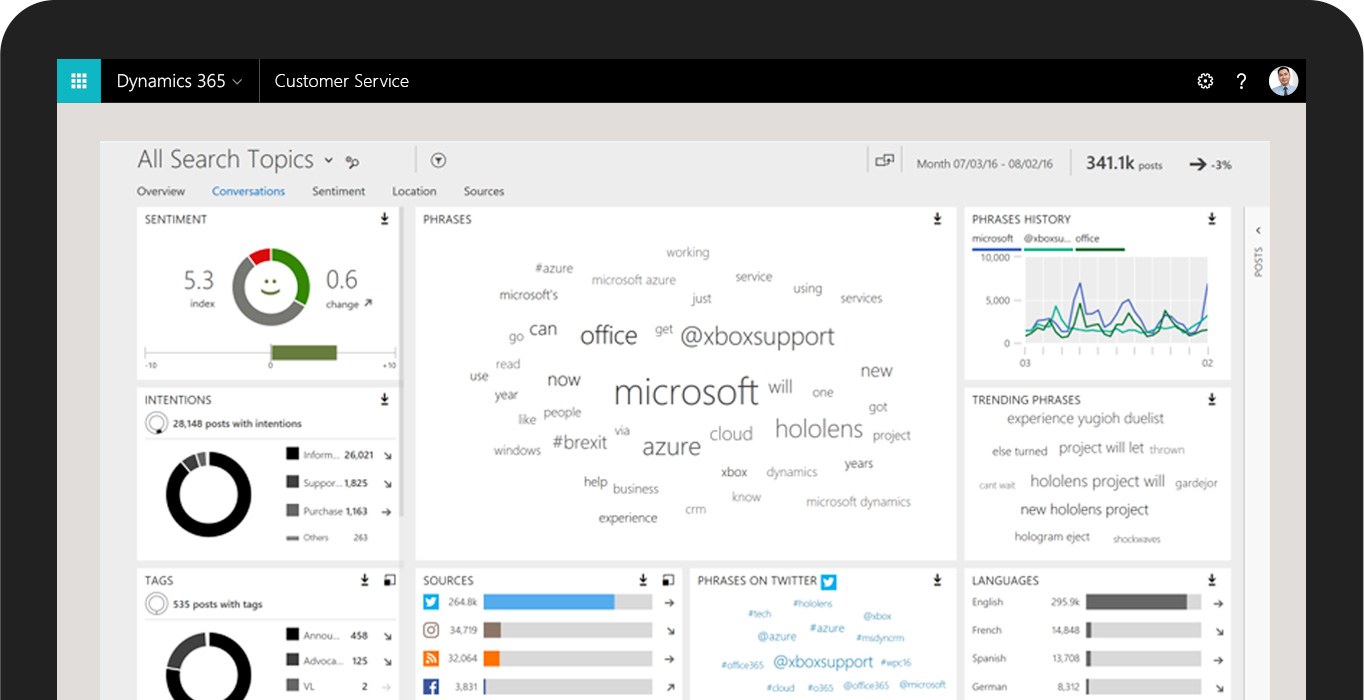

Dynamics 365 comes with Cortana Intelligence and robust Business Intelligence tools and apps. This bundle makes it a solid contender in the ERP market, with the advantage of comparatively lower cost and easier implementation. Built with Microsoft technologies, it seamlessly integrates and synchronizes with most other Windows applications. For example, Dynamics 365 can sync with Outlook allowing users to update sales quotes and inventory directly from email

ERP is a massive integrated system and users are required to train for weeks or months. For Dynamics 365 Finance and Operations, the learning curve is short. It gets a winning edge over others, due to its simple look and feel. The UI is straightforward and the easy to understand interface are key factors for purchasing. An overview of Dynamics 365 is pictured below.

| Key Strengths | Key Weaknesses |

| Affordable for SMBs | Limited support from integrators |

| Smooth learning curve | Limited functionalities in certain areas |

| Easy integration of CRM | Lack of proof of scale for enterprise level ERP |

| Microsoft assets (Cortana Intelligence and BI tools, Azure) |

SAP Overview

SAP is known as a market leader in ERP and an ideal solution for organizations. SAP is offered in 37 languages, 45 localizations, and 25 industry verticals. It has a strong standing in the market with about 50,000 customers. The functional modules–Plan to Product, Order to Cash, Request to Service, Core Finances, Core Human Resources, covers your every industry’s needs.

Not only does SAP fit the needs of multi-national organizations, but it is a friendly software solution for small enterprises too. SAP ERP can cater to all business size needs and delivers what it promises, but the cost is comparatively much higher than its competitor ERP Solutions. If consistency is important, then SAP is an excellent choice; its straightforward implementation can be customized using third-party solutions.

SAP offers various ERP options to accommodate different market segments. For example, SAP Business By Design adapts to smaller companies who may not need full functionalities. This version focuses on ease of use and simplicity, a modern user interface and mobility.

| Key Strengths | Key Weaknesses |

| Established market leader | System complexity |

| Depth of functionality | Steep learning curve |

| High integration of modules | Longest payback period |

Selection criteria

Now that we’ve set the table by describing each product and main strengths and weaknesses, let’s see what criteria to use when comparing ERP systems.

The data below is summarized from a study conducted by Panorama Consulting Solutions.

| Criteria | Dynamics 365 | SAP | Winner |

| Implementation duration: Many factors influence implementation duration, including implementation approach, type of software, complexity of business processes, industry, organization size and level of customization. | 23.6 months | 23.1 months | Draw |

| Total cost of ownership: This includes the cost of the actual system as well as the costs of implementation and customization. | $2.06 Million | $2.09 Million | Draw |

| Benefits realized: This metric indicates the percentage of organizations who realized 50% or more of their planned benefits with their ERP. | 26% | 34% | SAP |

| Functionality achieved: This metric refers to the percentage of the software used. It is the percentage of companies which have achieved More than 50% of functionality of their ERP. | 44% | 80% | Dynamics 365 |

| Payback period: Payback is the point in time when the organization recoups its initial investment. | 12 months | 30 months | Dynamics 365 |

What does this mean?

If you were hoping by this point in the article you would have a clear-cut answer to your question, sorry to disappoint you. Selecting an ERP is a long process, and should be given thoughtful consideration. The reality is that some businesses will benefit more from Dynamics 365 and some will benefit from SAP.

Examine your organization’s future roadmap and do a careful study of your business requirements. Make sure to analyze architecture, functionality, acquisition plans and product lines.

Having said this, choosing the right ERP is only part of the solution. When the ERP is selected, you will want to implement it correctly within your organization. You will need to modify your business processes to fit the ERP. You can facilitate the long journey by selecting the right implementation partner.